In our Article, ‘The ‘Tough’ Negotiator’, we raise the issue of what makes a tough negotiator in context of understanding that there are different types of negotiation. In describing the different types, we highlighted dilemmas a negotiator might feel approaching the negotiation – for example, “ .. whether to compete or collaborate; or similarly between motivations to try to claim value (e.g. a log of claims in an industrial setting) or create value; or whether to be empathetic or brutally honest.”

We also pointed out that negotiation behaviour is a choice. In this sense, if both parties choose to collaborate it is likely that ‘value’ will be created in the negotiation and in the final settlement mutual gains is possible (note we have not used the phrase win/win here). On the other hand, if both parties choose to compete, it is unlikely that value will be created in the negotiation and what is perceived as a ‘fixed pie’ will be divided in the settlement. At this point, you may be asking, “Well, what if one party tries to collaborate and the other party competes?” This is a very good question, and one we will turn to at the end of this Insight. For now we want to stay with the term ‘value’ and its connotations.

So what is value? In a very narrow sense, value can be simply equated with a monetary value – i.e. $. In a dispute (e.g. a law suit), or the purchase and sale of a one-off item (like buying a car off an on-line seller), value is mostly confined to money. But is money the only value item in these deals? What of time and method of payment? Isn’t there a value in getting finality and waking up the next day and knowing that the deal is behind you? In this sense there is value in the terms of the deal struck, but also in the finality of the deal.

The point we are raising here is that in any deal there are multiple dimensions of value, and understanding this is critical for getting the deal you want – regardless of the type of negotiation. Since it is so important, let’s take the analysis a little further on how to get that deal.

Outcomes (in most corners of life) are the result of the systems and processes that deliver them. For example, if the car I have purchased is in fact a lemon, that outcome is a consequence of a production process. Whether it is fixed under warranty is also a consequence of the guarantee negotiated or offered and so on. By extension, if we end up with a poor deal following negotiation our inquiry might be: “What happened in the process?” In their text, ‘Getting to Yes’[1], Fisher et al say that simply arguing about positions can leave value on the table or lead to no deal. Instead, they argue that we need to go beyond what negotiators are asking for (their claim or position) and understand what their ‘needs and interests’ are behind those positions. The simple example they give is a negotiation over ownership of an orange. In the course of the negotiation, each party learns they have need and interests – i.e. one wants the juice and the other the rind. In the deal, one gets the juice and the other the rind and so each gets what they want. The example is simple, and in some quarters has been criticised for not being applicable in cases where, for example, there are limited resources (e.g. both want the juice). We will comment on this further at the end of this insight when we deal with the claim/create value choice. At this point, we want to stay with the concepts of needs and interests.

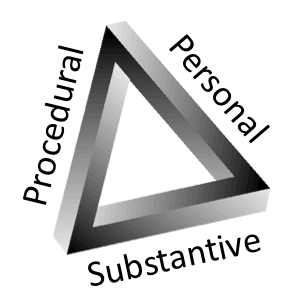

In thinking about interests of a party to negotiation, these can be separated into substantive interests (what is being negotiated), procedural interests (what is going on in the process), and personal interests (emotional needs). Sometimes these types of interests can be listed under headings and so be seen as disparate. We don’t see interests this way. Indeed, our brand at the top of this page includes a ‘Penrose triangle’ which shows three sides of what appears as a two-dimensional triangle, but then it also appears as a three dimensional shape as you follow its lines. We have used this triangle to depict what is at the heart of how we go about helping people resolve issues – dialogue and negotiation dynamic! In short, the negotiation process changes constantly, and understanding this is critical to the negotiated outcome. To assist with this understanding, then, let us talk quickly about each side of the triangle.

Graphically, the triangle might be depicted thus:

For the purpose of illustrating the force in understanding the dynamics and interplay of each dimension of interests, suppose A and B are about to represent their organisations in the negotiation of a deal for the supply of services by B to A for three years. The negotiation begins by email and A sends an email to B saying that they see B’s organisation as the preferred supplier given their ‘current contract’ for other services and that the price A’s company is only willing to pay is $X per service for three years. A also stipulates that billing should occur at the end of each three monthly period.

So far the substantive side of the triangle is in play; as is the procedural side, with the email process in train. Having read the email, B is perplexed. First, A’s company is ‘only willing’to pay $X. Second, A is attempting to hold B’s company to ransom in offering the contract because of ‘current contracts’. And finally, three monthly billing for a price fixed for three years? Really? Now, the third side of the triangle is well and truly in play!

How would we describe this process – one of trying to claim, or create value? What should B’s response be? Should it be by email and only take issue with each point issue raised by A: “We don’t accept your offer/proposal. What we ‘offer’ in return is a 4 year deal indexed for CPI, and billing 30 days.”

Rather than respond in such terms, B could take an ‘interests’ approach. For example, B could phone or email A and ask to meet in person to talk over the proposal. By doing this B could begin to move the dialogue to being about interests. First, on the procedural side, the proposed process removes the perception bias risk in reading emails and so ensure procedural certainty. Second, it may also give B an opportunity to clarify his/her personal reaction to A’s email. And third, it gives B and A the opportunity to discuss, among other things, the time imperative on account payment – e.g. why A is asking for 3 months and B 30 days. For example, what are A and B’s interest (including priority) on this – e.g. cash flow, risk of payment, other. Importantly, if the two parties have different preferenceson these issues it may allow trading and a deal to be struck.

The context of the example we have given is that there is an existing relationship and a prospect of an ongoing one. And that is another interest of the parties to consider. This point, however, also takes us back to the point about whether to compete (claim value) or collaborate (create value). In negotiation theory, this is what is called the ‘mixed motive dilemma’.[2]Practice and research tells us that if one party competes and the other tries to collaborate, additional value in the deal may be found, but that the biggest share of that value will go to the person who competed. So how do we deal with this? There are a number of ways, but two options include: (a) Negotiate the negotiation – i.e. negotiate the process first thing, and create some certainty around what, inter alia, good faith means; and (b) If having done that, and the other party tries to take advantage during the process then you can go back to what was agreed and walk to your BATNA (Best Alternative to a Negotiated Agreement) if necessary.

When parties commence negotiating, of course they are ‘interested’ in a deal – why else would they be there? Understanding relevant interests (and all three dimensions) makes a prospective deal more likely.

P Raffles

(Advisor/Negotiator/Coach/Mediator)

[1]Fisher, R., Patton, B. and Ury, W., ‘Getting to Yes: Negotiating and agreement without giving in’, Century Business, 1991

[2] McKersie, R. and Walton, R., “A Behavioral Theory of Labor Negotiations”, McGraw hill, 1965.